If I’m being honest: Hawaii was not in the cards for us this year. We had already paid for a bucket list trip to Africa that we’re going on later this month and had incurred quite a few big house expenses. But then last year I started getting serious about playing the credit card points game, and suddenly it became more realistic. And that’s how we wound up going to Hawaii on credit card points for my 40th birthday.

You don’t have to be rich to play the credit card points game, and no, it won’t affect your credit score so long as you pay off your statement balance in full each month. In fact, the majority of people I know who learn points hacking do so as a way to get rewarded for money they’re already spending, which they then bank for a special trip (or trips) down the road, like my 40th birthday.

This post was last updated in September 2023.

Hawaii on points, however, was one of my biggest creative travel challenges to date, for a couple of reasons. One, Hawaii in February is high season, both because of the weather on the mainland and because it’s peak whale season (plus, we were there over Valentine’s and President’s Day weekend!). Two, we didn’t start planning this trip until mid-October with a departure date less than four months in the future. Typically, you’ll maximize the use of points with rewards trips when booked nine to 11 months out, which is why we’ve already booked our big international trip for next year.

Related article: Travel Hacking for Beginners: The Best Travel Credit Cards

And yet, with a lot of late-night planning and multiple spreadsheets, we were able to make it happen and jet off to the South Pacific for 11 days in February.

mural in Kahului by Joey Rose & Alexandra Underwood

Hawaii on points: the flights

Flights to Hawaii from Tennessee are now easy with Southwest servicing the islands. Originally, I had booked each of us round-trip flights from Nashville to Maui connecting in Phoenix with a combination of LUV vouchers and Southwest Rapid Rewards points. Then, I landed Companion Pass status in January and was able to cancel SVV’s flight, get all those points back in my account and book him for free as my companion. Here’s how I got Companion Pass status for two full years without flying a single mile.

In the end, the flights were the cheapest part of our trip, despite it being high season in Hawaii. Here’s what we spent:

- RT flights to Hawaii for 2: 39,238 points

- Out-of-pocket costs for flights: $11 in taxes

I also used my Southwest Performance Business card for free upgraded boarding on each long leg, as well as free in-flight WiFi for both Scott and me on each of our flights. You get 365 in-flight WiFi credits a year with this card!

Related article: Global Entry vs. TSA PreCheck: Which One is Better?

Hawaii on points: our vacation rental (3 nights)

For the first three nights of our Maui vacation, we stayed on the North Shore where hotels are few and cell service even less available. I really wanted to stay somewhere that felt authentic and local so we landed on a two-story rental house with ocean views right near Paia at Even the smallest Airbnbs in Hawaii are expensive, so I figured if we were going to go that route, we might as well pick a nice one.

Our total for a three-night stay would have been $2,591 with taxes and Airbnb fees. Since there are no longer Airbnb or VRBO referral credits, which is how I traveled for free for years, I wound up using a work-around. I paid myself back for part of the stay using Chase Sapphire Reserve card‘s PYB function, which is not currently available.

- 3 nights in a luxury oceanfront rental: 66,666 points

- Out-of-pocket cost: $1,591

I also did this when Airbnb had a 50% bonus going on, meaning my “cost” worked out to 1.5 cents a point instead of 1 cent a point, which is traditionally a pretty low value and why paying yourself back often is not the best use of points. You can sign up for the Chase Sapphire Reserve card here.

Related article: 13 Tips to Help You Survive Travel This Summer

Hawaii on points: our hotels (4 nights)

Hotels in Maui were the trickiest part of the points game. On average, when I was booking our Hawaii trip back in October, a four-star hotel ran $1,000 a night or more. Again, Maui is not a budget destination. I’m not particularly loyal to any of the big hotel chains, so for our three nights in Lahaina, I went with where I could get the most bang for my buck (er, points).

In this case, I was able to transfer Membership Rewards points from my American Express Platinum card over to my Marriott Bonvoy account when there was a 30% bonus going on. I think spent another $700 to upgrade to an ocean suite for each night. If I were to do it again, I probably would not have done the upgrade.

- 3 nights in an oceanfront room: 202,000 Marriott points

- Out-of-pocket cost: $700 to upgrade to the next room category, plus cover resort fees and parking

I admittedly did not get the best points redemption for any of my hotels, which I knew going into this; however, had I started planning this trip six months prior to when I did, my points would have likely gone further.

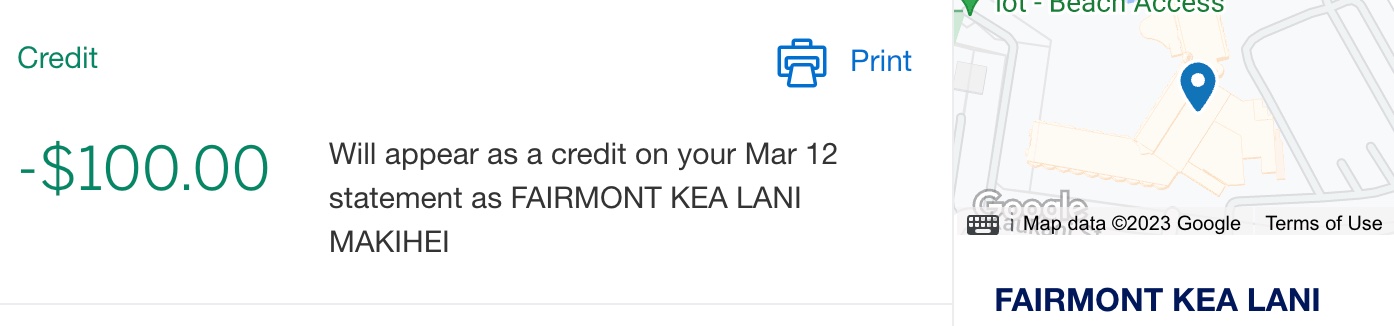

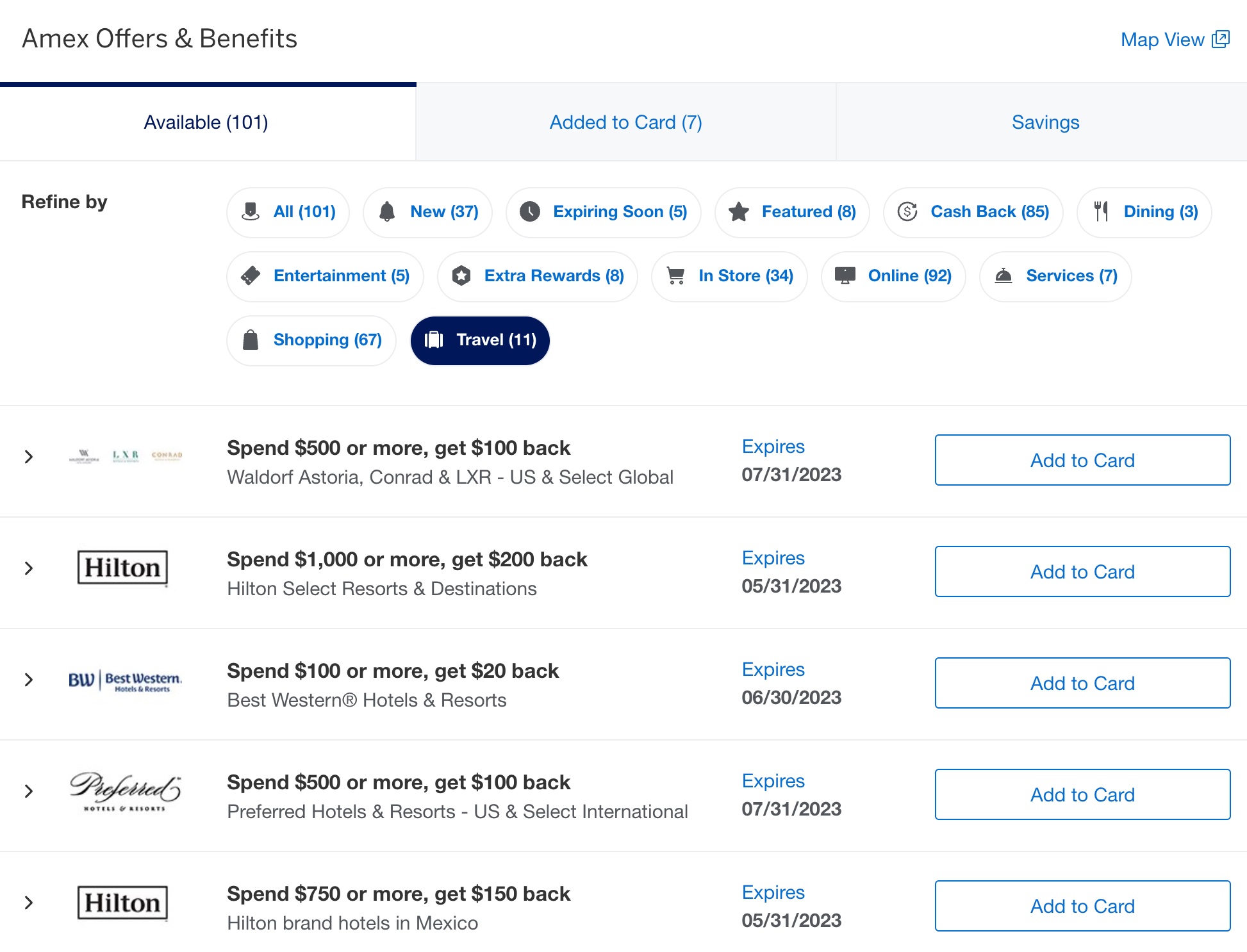

We did not use points for the Fairmont Kea Lani in Wailea, but rather got a promotional rate and paid for three nights plus resort fees with our AmEx Platinum, which earned us 3x points, plus had a special offer for a $100 credit to Fairmont properties at the time of our stay.

Pro tip: Always search the offers section for all your credit cards! They cost you nothing, but often will earn you money back for things you’re already buying.

A few days before we left for Maui, I realized one rookie mistake: I had somehow not booked a hotel for the last night we were on island! The Fairmont had been sold out due to it being a holiday weekend so extending was not an option. I quickly searched and found the Andaz a few doors down had availability, so I transferred 44,000 points over to my Hyatt account and booked a room.

- 1 nights in a king bedroom with resort view: 44,000 points

- Out-of-pocket cost: $110 for resort fees and parking

Hawaii on points: the activities

One thing I had never done before this trip was use points to book activities. We probably wouldn’t have done any excursions had I not realized there were plenty of bookable outings with Chase Ultimate Rewards points, a currency we usually have to spare. The doors-off helicopter tour wound up being an activity of a lifetime; 10 out of 10 would do it again.,

- Points used for helicopter ride for 2: 55,004

- Out-of-pocket cost: $0

Once I had booked our helicopter ride, I also realized the whale-watching operator I wanted to go out with was in the Chase Ultimate Rewards portal, as well. So I quickly booked a whale-watching excursion for both of us with Chase points.

- Points used for whale watching for 2: 13,420

- Out-of-pocket cost: $0

Since I was out of Chase Sapphire Reserve points at the time, we used points from SVV’s sign-up bonus for his own Chase card for both of these activities. You can sign up for the Chase Sapphire Preferred card here.

Note: Whale-watching is only offered part of the year, usually from November through April, but the same tour operators offer dolphin tours the other months of the year.

Hawaii on points: the rental car

Rental cars are where your budget can quickly get out of hand, particularly when you factor in the hefty airport taxes, so I was glad I found a rental car through Chase’s Ultimate Rewards portal when there was still plenty of car inventory.

Since I have Executive status with National Emerald Club thanks to my Capital One Venture X card—several other of these cards also offer that perk, FYI—we got an automatic upgrade from our economy booking and were able to pick our car from a whole line of mid-size and luxury vehicles. We opted for a Jeep Latitude, and the 4WD wound up being a necessity up on the rocky North Shore.

- Points used for a 10-day car rental: 77,384

- Out-of-pocket cost: $0

Always explore what special perks a credit card offers you, whether it’s Gold status with Marriott or Hilton, or elevated status with a rental car company, as these often come with many free benefits. You can sign up for the Chase Sapphire Reserve card here.

In summary, here’s what I spent in points

Was Hawaii on credit card points our cheapest trip to date? No. But it definitely made it attainable for us to take a luxury vacation on a more modest budget thanks to smart distribution of purchases across various credit cards. Here’s the exact breakdown of Hawaii on credit card points:

- 39,238 points Southwest Rapid Rewards points transferred from my Chase Sapphire Reserve card

- 202,000 AmEx Membership Rewards points for three nights at the Sheraton when there was a 30% bonus offer

- 44,000 Chase Ultimate Rewards points to Hyatt for one night at the Andaz

- 66,666 Chase Ultimate Rewards points used for 3 nights in an Airbnb when there was a 50% bonus offer

- 55,004 Chase Ultimate Rewards points for a helicopter trip for two

- 13,420 Chase Ultimate Rewards points for whale watching for two

- 88,000 Chase Ultimate Rewards points for a rental car for 10 days

Total points used: 498,712

In Maui, we usually ate breakfast in our room or at a food truck and had one meal out a day. I did not track our food and gas, because what’s the fun in knowing that (ha), but I did put all applicable purchases on our AmEx Gold and Chase Sapphire Reserve while on island to maximize additional points earned on the trip itself. The Gold offers 4x points on restaurants and groceries, and the Chase Sapphire Reserve offers 3x points on gas.

We also used the Centurion Lounges at each airport to eat and drink between flights and the monthly Uber credit—we get a cumulative $25 for free in Uber Cash each month through our AmEx cards—to get to and from the airport. And we knew that by booking on our AmEx and Chase Sapphire cards, we’d have back-up travel insurance should we need it. So using these cards served multiple purposes.

Here are all the credit cards I used for this trip

These were the credit cards I used for points redemption or spend on my Hawaii trip, ranked from my top card on down:

- American Express Platinum

- Chase Sapphire Reserve*

- American Express Gold

- Capital One Venture X

- Chase Sapphire Preferred*

- Southwest Performance Business

*Note: You can only hold one Sapphire product at a time, so this is when having a P2 (two-player mode) comes in handy with your strategy. If you’re a solo traveler, the Reserve would be my first pick of the two Sapphire products to get thanks to the lounge access and other perks.

Still confused about how to use credit card points? I wrote a beginner’s guide to credit cards for travel here.