It’s Southwest Companion Pass season, y’all! Are you ready for it? Four Decembers ago, I opened my first Southwest credit cards and was set to hit the minimum spend on them early the following year. That would have given me the Southwest Companion Pass status for nearly two years—then 2020 arrived and we all know what happened. We didn’t fly for the better part of 18 months, and our expenses dropped down to almost nothing.

But last year, I was on a mission—and by following the below status, I achieved Southwest Companion Pass for two years by simply putting my monthly expenses on the card. In that time, my companion has flown for free to San Francisco, Cincinnati, Los Angeles, Atlanta, Portland, New Orleans and more. Here’s exactly how I did it—and how you can sign up for Southwest cards to also have your partner or plus-one fly for free.

This post was last updated in May 2024.

What is Southwest Companion Pass?

If you live in a major Southwest Airlines market, you’ll likely know about Southwest Companion Pass (or SCP as I’ll refer to it in this article). After all, it’s essentially a buy-one-get-one-free deal: You book your seat, and your companion flies for free.

The cool thing about SCP is that there are no blackout dates; so long as there are seats open and you are booked on a flight, your companion can also fly for just the cost of taxes ($5.60 each way on a Southwest flight). Given that SVV and I fly Southwest several times a year—and that there are now SWA flights to many Caribbean destinations, as well as the various Hawaiian airlines—this is a perk we would use often. And it would save us thousands of dollars a year on the travel we’re already doing.

How to get Southwest Companion Pass

You can earn Southwest Companion Pass by racking up 135,000 qualifying points. What counts as a qualifying points? A mile flown or a mile earned through a Southwest credit card. You also earn qualifying points through partner hotel stays, credit car rentals and more. You do not earn qualifying points through purchased miles or transferred points. See everything that counts toward Companion Pass status here.

This is a great time to open credit cards for several reasons: You can quickly hit your minimum spend for those bonus points through holiday shopping or the property tax or income tax you’ll be paying in the beginning of the year. Most credit cards require you hit a certain threshold within three months, which would give you through March to meet your spend if you applied today. We always have so many expenses coming up in January—self-employment tax, payroll tax, property tax on all of our real estate holdings—that it makes sense for us to maximize our point accrual (i.e. get free money from it) and pay off our balance in full each month.

Credit card bonuses change all the time. You can check out the current bonus offers on Southwest’s business card here.

And yes, the IRS allows you to pay your taxes with a credit card. In many cases, like ours, that 1.96% pays off in as much as $2,000 of free travel with the points bonuses.

Strategy #1: Fly 135,000 miles (or 100 one-way legs)

Southwest Companion Pass can obviously be achieved if you’re a corporate traveler who flies a few legs a week all year long. But for the rest of us plebeians who spend more time on the ground than in the air? It’s a whole other game of chess that includes accumulating enough credit card points in the right calendar year.

Strategy #2: Open two Southwest business cards

You need to figure out a way to reach 125,000 points this year or 135,000 points next year to earn SCP. That can be achieved through two credit card bonuses, plus the dollars you spend on them. Opening two Southwest business cards is a good strategy because neither one of them take up a slot in your coveted Chase 5/24 (more about that here if you don’t know what it means). Currently both Southwest Rapid Rewards Business Credit Cards have an 80,000-point bonus.

And if you do have businesses, you’ll likely hit the minimum spend quicker as it’s inevitably higher than that of personal cards—for example, I have a business credit card that I use solely for photography equipment, and that sucker gets used a lot.

That said, you don’t necessarily have to have a registered business to get a business credit card. Even if you have a side hobby (blogging, selling on Etsy, mowing lawns), you can get a business card by using your social security number when it asks for an EIN. You don’t, however, want to apply for a second card within 30 days of your last; that’s just a good rule of thumb to follow in general.

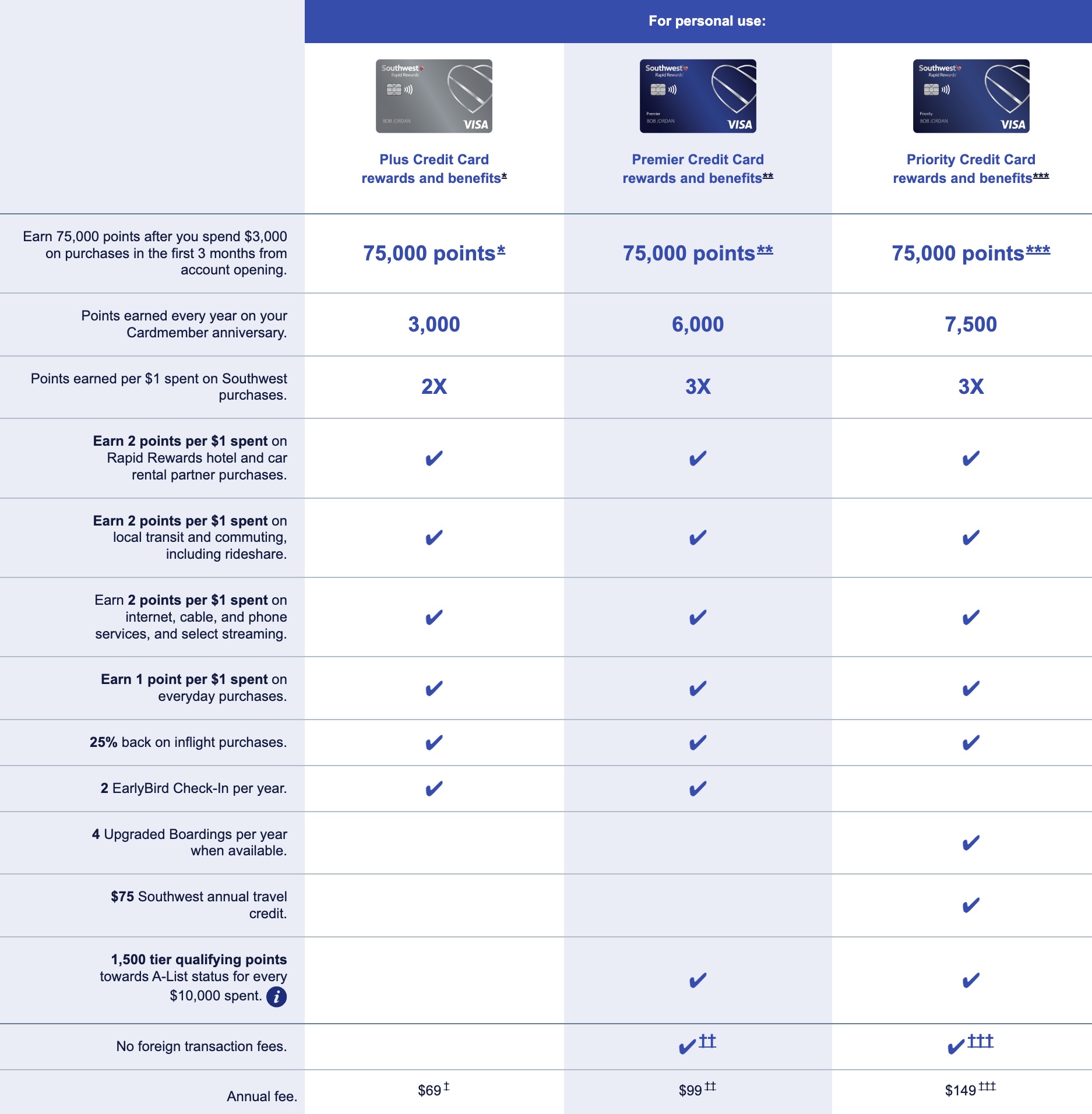

Strategy #3: Open a Southwest personal card and a business card

Opening one Southwest personal card and one business card is your best chance at betting approved for both on the first go. If you have a high credit score and low credit utilization and have opened less than five personal cards across banks in the past 24 months, you should be good to get approved for one of the Southwest personal cards with Chase. These usually have a minimum sign-up bonus of 60,000 points, but currently are at 75,000 points for the next few weeks.

Chase is notoriously hard on card owners having multiple business cards opened in a short span of time. That said, you could always apply for a second biz card and if you don’t get approved, then you have the personal card ace in your pocket as a backup.

Note: You can only get a Southwest personal credit card bonus if you have not opened one within the past 24 months (this doesn’t apply for a business card). If you currently hold a personal card and it’s been more than 24 months, you can cancel it, wait 30 days, then reapply for the same card. This won’t hurt your credit unless it’s your oldest credit card (never cancel your oldest credit card!).

Related Article: Travel Hacking for Beginners: The Best Travel Credit Cards

When you should get Southwest Companion Pass

The best time to open a Southwest card is in the fall months, so you can hit the bonus spend the first week of January, then you’ll have nearly two years of Companion Pass status. Doing this in the fall during your holiday shopping when you’re already spending money just makes sense.

One BIG thing to remember

All your points (or miles) have to post in the calendar year you want to earn companion status. In other words, if you hit the minimum spend on Dec. 27, they will count for this year and not next. Why does this matter? Because if you hit CSP status on Jan. 2, for example, you’ll have a Southwest companion pass for the entire calendar year and the next. In other words, that’s two years of your companion traveling for free, whereas if you hit it now, you’ll only have next year.

Other FAQs about the Southwest Companion Pass

Still have questions? Leave them in the comments, and I’ll answer right here.

Where all can I go with a Southwest Companion Pass?

Literally, anywhere Southwest flies!

What if I want to take my mom on one trip and my spouse on another?

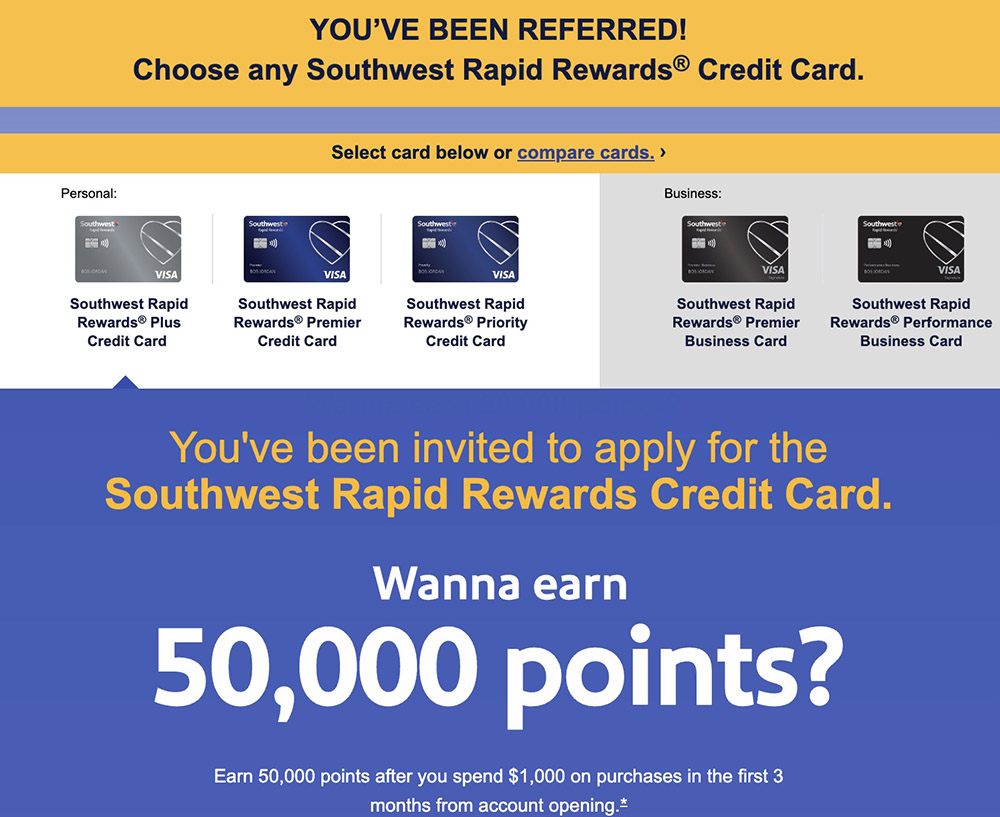

You absolutely can! With the Companion Pass, you can have up to four guests a year, meaning you can change your companion up to three times max. So, for example, you could take your spouse on a trip, switch it to your mom for a trip, switch it back to your spouse, then switch to your mom one final time. You should refer your spouse if you go this route, as that’s 20,000 points per card that you will bank in your own Rapid Rewards account.

How else can I earn points toward Companion Pass?

Once you’ve opened any Southwest credit card, you can refer friends for 20,000 points (up to 100,000 a year), each referral of which will go toward your qualification.

What if I have two kids? Can I get two Companion Passes?

If you have a second flier (called a “player two” or P2 in the travel points space), then absolutely. You can get SCP with your Rapid Rewards account, and P2 can do the same as you. If you’re traveling with a family, it’s always smart to mimic what the other card holder is doing and have one person refer the other to get those bonus points.

But, Kristin, these card have annual fees.

For me, $69 a year is completely worth my partner flying for free! You can always cancel them after you’ve achieved your Companion Pass—but never, ever cancel a card until you’ve passed the one-year mark—right before the annual fee for the following year hits. All the points you earn are miles, so they go directly into your Rapid Rewards account versus accumulate in Chase’s Ultimate Rewards ecosystem like the Sapphire cards.

SAVE THIS POST ON PINTEREST FOR LATER

Solid advice! Looking forward to more travel this year. Thanks!!

I opened my business card in august (I already have a personal card and got that signup bonus as well), with the intention of meeting the business bonus early in January to meet the 135k companion pass threshold. So I should get the companion pass for 2024 to December 2025, correct? A southwest agent just told me though that I will need to meet my spending threshold for the companion pass BEFORE December 31 or I will start from zero for the companion pass in 2024. This sounds incorrect based on everything I’ve read about getting nearly two years of companion pass flying, but I’d hate to be wrong in this!!

If you’ve already gotten the SUB for the business card and it applied to your account in 2023, then unfortunately you would need to finish out the points in this calendar year and then you’ll have CP for all of 2024. So in this case, you’ll want to go ahead and cross the threshold before the end of the year to hit your 135,000 and you’ll have CP for all of next year.

The strategy to get it for two years is to open two cards in the last quarter of the calendar year and then clear the threshold for **both** in January of the following year (totaling 135,000) as you have to accumulate 135,000 points in a single calendar year. Does that make sense?

Hi! It’s Dec 29, 2023, is it too late to open a southwest credit card and start the process you mentioned above? Or would I open today, then wait until Jan 1 to spend the $1000 minimum? Thanks!!

Definitely not too late! The only thing you’d need to worry about is getting your bonuses too early (in December), and you’re past that point so you’re good.

Basically, whenever you pass the threshold of 135,000 points (collected in a calendar year), your CP will start for the duration of that year and the entire following year. So clearing that in January maximizes your usage as it gives you nearly 24 months, but in theory, you can do this anytime =)