When we first purchased our Victorian back in 2012, I’ll admit I had no idea what we were doing. The concept of spending so much money on a single item was foreign to me; prior to that, plane tickets were about the most expensive purchases I’d ever made with my own money.

We wound up getting pre-approved for a VA loan that was double the amount that our old fixer-upper cost; knowing that we could afford more than we were paying on our mortgage and that SVV was confident of his experience in revitalizing houses, we decided to take out an additional construction loan to tackle some of the bigger picture items to increase the value of our home long-term. While our 1800s house was in decent enough shape—for example, the plumbing and electrical had been updated in recent years, otherwise we would never have touched it—still, it needed a lot of work.

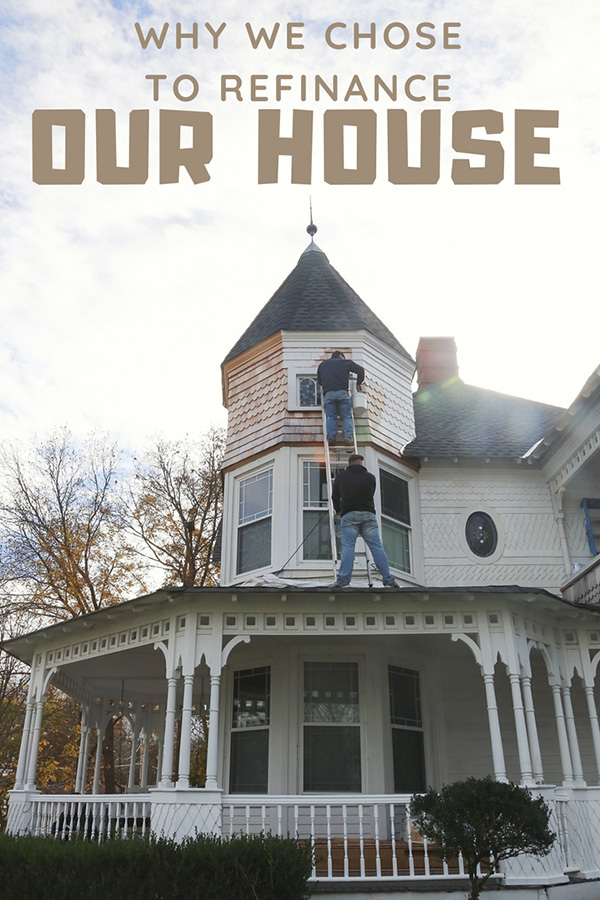

Our house before we bought it, in 2012

It wasn’t until we moved in that we realized the magnitude of labor it would require. We knew there would be a good deal of aesthetic improvements—such as laying hardwood floor where there was just plywood, building back up some of the fireplaces that were crumbling into dust, demo-ing both bathrooms due to moisture seepage and mold—but within a week, water was pouring into the master bedroom through the chandelier, and we learned we’d also need a new roof.

A year later, it was clear we’d have to replace all the siding, as well, which would then have to be painted on top of that. These types of major home improvement projects are necessary for the longevity of your house, but they’re also costly, and I cringed every time I’d sign off on yet another home expense. That construction loan went very, very quickly.

We didn’t really consider refinancing until we’d had a substantial amount of work behind us: the siding, the roof, the repainting, the fence we built to enclose the lot, and the various other odd jobs we tackled here and there that added to the value. We ultimately refinanced to pay off the construction loan, and I can’t tell you how good that felt two years ago when we were no longer writing two checks to the bank each month. Our construction loan came with a high interest rate, too, so we weren’t even paying it down over those first four years; we were simply spending money to sustain it.

Our house now, in 2018

Last year, we purchased another investment property, and if you follow along my social media, you’ll see that we’ve improved the value significantly there, too. We upgraded the electrical and plumbing, we took out walls, we painted both the exterior and the interior, we took one bathroom down to the studs, we installed a kitchenette, and we furnished it. And since we did the bulk of the work ourselves, it ran us less than $20,000 in total renovation costs. If I were to guess, I’d say it’s already worth 160 percent of what we paid for it, and in another year or two of us tinkering away, we may refinance it, too, so we have a cash infusion to make it into a co-working space, a recording studio or possibly both.

Considering refinancing yourself? Here’s what I’d recommend to you:

1. Take a cold, hard look at your finances to see if refinancing makes sense. There are fees, percentage rates, potentially higher monthly payments and a whole host of other things to consider with experts before moving forward. If you’re in a decent neighborhood, comfortable in your jobs and the economy is healthy it’s usually a good move and a nice boost up the economic ladder

2. Put in the “sweat equity” prior to considering a refi. This is labor that you or your family put into renovation that translates to value in your property. Because the labor is “free,” you’ll save a boatload on expenses. SVV is a big proponent of paint and flooring being the biggest ROI for the effort. It’s amazing how much value you can add by doing these two things.

3. Consider how long you plan to own the property. If you’re building a forever home or planning to spend a significant amount of time in one house, taking out a new mortgage by refinancing the property often makes sense. A mortgage lender can help determine your refinancing options and figure out when is the best time to refinance for your circumstances.

Home ownership is a wonderful thing and, in many ways, one of the keys to moving up in our country. I’ve loved owning a piece of property we can pour our hearts and soul into, and rehabbing a historic home like ours has given us a certain sense of pride, mad respect within our community and enhanced our ability to work together on large projects.

I have a lot of upcoming content surrounding our decision to purchase an investment property and how we tackled that in an affordable and mindful manner, but in the meantime: What questions do you have about refinancing? Are you a homeowner? Have you ever refinanced your own house?

PIN IT HERE

I also bought in 2012 and refinanced about three years later. I had only put 10% down when I bought (FHA loan) and was paying about $350 a month in PMI. The value of my house had gone up (I made improvements, and the market value improved) so I thought it was time. I was able to get the same interest rate, and just had to pay the closing costs. Doing the math though, refinancing paid itself off in about a year. And three years later, I am still loving my home!

Projects do take a lot of time, patience, and money though. I try to tackle smaller items on my own, but I recently got hardwood and new carpet put in and that certainly was not cheap, even if it does improve the value of my house!

These projects are so incredibly impressive! Furnishing my tiny appartment cost me a lot of headaches for the period of three months. I don’t think I could ever tackle a project as big as this. I’ve seen your work throughout the years though, and it looks absolutely beautiful!

I refinanced my house five or six years ago, back when interest rates were super, super low. It ended up saving me some money, which was great.

Your house is #goals!

Great Read, Well done on your house!!

Lovely home and traditional wooden stair and interiors. I always love to have a home like this. 🙂